CONTENTS

1 Introduction

2 GPT Diffusion Theory

3 The First Industrial Revolution and Britain’s Rise

4 The Second Industrial Revolution and America’s Ascent

5 Japan’s Challenge in the Third Industrial Revolution

6 A Statistical Analysis of Software Engineering Skill Infrastructure and Computerization

7 US-China Competition in AI and the Fourth Industrial Revolution

8 Conclusion

1 Introduction

IN JULY 2018, the BRICS nations (Brazil, Russia, India, China, and South Africa) convened in Johannesburg around a specific, noteworthy theme: “Collaboration for Inclusive Growth and Shared Prosperity in the Fourth Industrial Revolution.” The theme was noteworthy in part because of its specificity. Previous iterations of the BRICS summit, which gathers five nations that account for about 40 percent of the world’s population and 25 percent of the world’s GDP,1 had tackled fuzzy slogans such as “Stronger Partnership for a Brighter Future” and “Broad Vision, Shared Prosperity.” What stood out not only about that year’s theme but also in comments by BRICS leaders at the summit was an unambiguous conviction that the world was undergoing a momentous season of technological change—one warranting the title “Fourth Industrial Revolution.”2

Throughout the gathering, leaders of these five major emerging economies declared that the ongoing technological transition represented a rare opportunity for accelerating economic growth. When Chinese president Xi Jinping addressed the four other leaders of major emerging economies, he laid out the historical stakes of that belief:

From the mechanization of the first industrial revolution in the 18th century, to the electrification of the second industrial revolution in the 19th century, to the informatization of the third industrial revolution in the 20th century, rounds of disruptive technological innovation have … fundamentally changed the development trajectory of human history.3

Citing recent breakthroughs in cutting-edge technologies like artificial intelligence (AI), Xi proclaimed, “Today, we are experiencing a larger and deeper round of technological revolution and industrial transformation.”4

While the BRICS summit did not explicitly address how the Fourth Industrial Revolution could reshape the international economic order, the implications of Xi’s remarks loomed in the backdrop. In the following months, Chinese analysts and scholars expanded upon them, especially the connection he drew between technological disruption and global leadership transitions.5 One commentary on Xi’s speech, published on the website of the authoritative Chinese Communist Party publication Study Times, detailed the geopolitical consequences of past technological revolutions: “Britain seized the opportunity of the first industrial revolution and established a world-leading productivity advantage.… After the second industrial revolution, the United States seized the dominance of advanced productivity from Britain.”6 In his analysis of Xi’s address, Professor Jin Canrong of Renmin University, an influential Chinese international relations scholar, argued that China has a better chance than the United States of winning the competition over the Fourth Industrial Revolution.7

This broad sketch of power transition by way of technological revolution also resonates with US policymakers and leading thinkers. In his first press conference after taking office, President Joe Biden underscored the need to “own the future” as it relates to competition in emerging technologies, pledging that China’s goal to become “the most powerful country in the world” was “not going to happen on [his] watch.”8 In 2018, the US Congress stood up the National Security Commission on Artificial Intelligence (NSCAI), an influential body that convened leading government officials, technology experts, and social scientists to study the national security implications of AI. Comparing AI’s possible impact to past technologies like electricity, the NSCAI’s 756-page final report warned that the United States would soon lose its technological leadership to China if it did not adequately prepare for the “AI revolution.”9

Caught up in the latest technical advances coming out of Silicon Valley or Beijing’s Zhongguancun, these sweeping narratives disregard the process by which emerging technologies can influence a power transition. How do technological revolutions affect the rise and fall of great powers? Is there a discernible pattern that characterizes how previous industrial revolutions shaped the global balance of power? If such a pattern exists, how would it inform our understanding of the Fourth Industrial Revolution and US-China technological competition?

Conventional Wisdom on Technology-Driven Power Transitions

International relations scholars have long observed the link between disruptive technological breakthroughs and the rise and fall of great powers.10 At a general level, as Yale historian Paul Kennedy has established, this process involves “differentials in growth rates and technological change, leading to shifts in the global economic balances, which in turn gradually impinge upon the political and military balances.”11 Yet, as is the case with present-day speculation about the effects of new technologies on the US-China power balance, largely missing from the international relations literature is an explanation of how technological change creates the conditions for a great power to leapfrog its rival. Scholars have carefully scrutinized how shifts in economic balances affect global military power and political leadership, but there is a need for further investigation into the very first step of Kennedy’s causal chain: the link between technological change and differentials in long-term growth rates among great powers.12

Among studies that do examine the mechanics of how technological change shapes economic power transitions, the standard explanation stresses dominance over critical technological innovations in new, fast-growing industries (“leading sectors”). Britain became the world’s most productive economy, according to this logic, because it was home to new advances that transformed its burgeoning textile industry, such as James Hargreaves’s spinning jenny. In the same vein, Germany’s mastery of major breakthroughs in the chemical industry is seen as pivotal to its subsequent challenge to British economic leadership. Informed by historical analysis, the leading-sector (LS) perspective posits that, during major technological shifts, the global balance of economic power tips toward “the states which were the first to introduce the most important innovations.”13

Why do the benefits of leading sectors accrue to certain countries? Explanations vary, but most stress the goodness-of-fit between a nation’s domestic institutions and the demands of disruptive technologies. At a general level, some scholars argue that rising powers quickly adapt to new leading sectors because they are unburdened by the vested interests that have built up in more established powers.14 Others point to more specific factors, including the degree of government centralization or sectoral governance arrangements.15 Common to all these perspectives is a focus on the institutions that allow one country to first introduce major breakthroughs in an emerging industry. In the case of Britain’s rise, for example, many influential histories highlight institutions that supported “heroic” inventors.16 Likewise, accounts of Germany’s success with leading sectors focus on its investments in scientific education and industrial research laboratories.17

The broad outlines of LS theory exert substantial influence in academic and policymaking circles. Field-defining texts, including works by Robert Gilpin and Paul Kennedy, use the LS model to map out the rise and fall of great powers.18 In a review of international relations scholarship, Daniel Drezner summarizes their conclusions: “Historically, a great power has acquired hegemon status through a near-monopoly on innovation in leading sectors.”19

The LS template also informs contemporary discussion of China’s challenge to US technological leadership. In another speech about how China could leverage this new round of industrial revolution to become a “science and technology superpower,” President Xi called for China to develop into “the world’s primary center for science and high ground for innovation.”20 As US policymakers confront China’s growing strength in emerging technologies like AI, they also frame the competition in terms of which country will be able to generate radical advances in new leading sectors.21

Who did it first? Which country innovated it first? Presented with technical breakthroughs that inspire astonishment, it is only natural to gravitate toward the moment of initial discovery. When today’s leaders evoke past industrial revolutions, as Xi did in his speech to the BRICS nations, they tap into historical accounts of technological progress that also center the moment of innovation.22 The economist and historian Nathan Rosenberg diagnoses the problem with these innovation-centric perspectives: “Much less attention … if any at all, has been accorded to the rate at which new technologies have been adopted and embedded in the productive process. Indeed the diffusion process has often been assumed out of existence.”23 Yet, without the humble undertaking of diffusion, even the most extraordinary advances will not matter.

Taking diffusion seriously leads to a different explanation for how technological revolutions affect the rise and fall of great powers. A diffusion-centric framework probes what comes after the hype. Less concerned with which state first introduced major innovations, it instead asks why some states were more successful at adapting and embracing new technologies at scale. As outlined in the next section, this alternative pathway points toward a different set of institutional factors that underpin leadership in times of technological leadership, in particular institutions that widen the base of engineering skills and knowledge linked to foundational technologies.

GPT Diffusion Theory

In September 2020, the Guardian published an opinion piece arguing that humans should not fear new breakthroughs in AI. Noting that “Stephen Hawking has warned that AI could ‘spell the end of the human race,’ ” the article’s “author” contends that “I am here to convince you not to worry. Artificial intelligence will not destroy humans. Believe me.”24 If one came away from this piece with the feeling that the author had a rose-tinted view of the future of AI, it would be a perfectly reasonable judgment. After all, the author was GPT-3, an AI model that can understand and produce humanlike text.

Released earlier that year by OpenAI, a San Francisco–based AI lab, GPT-3 surprised everyone—including its designers—with its versatility. In addition to generating poetry and essays like the Guardian op-ed from scratch, early users demonstrated GPT-3’s impressive capabilities in writing code, translating languages, and building chatbots.25 Six months after its launch, one compilation listed sixty-six unique use cases of GPT-3, which ranged from automatically updating spreadsheets to generating website landing pages.26 Two years later, OpenAI’s acclaimed ChatGPT model, built on an improved version of GPT-3, would set the internet aflame with its wide-ranging capabilities.27

While the name “GPT-3” derives from a class of language models known as “generative pre-trained transformers,” the abbreviation, coincidentally, also speaks to the broader significance of recent breakthroughs in AI: the possible arrival of the next general-purpose technology (GPT). Foundational breakthroughs in the ability of computers to perform tasks that usually require human intelligence have the potential to transform countless industries. Hence, scholars and policymakers often compare advances in AI to electricity, the prototypical GPT.28 As Kevin Kelly, the former editor of WIRED, once put it, “Everything that we formerly electrified we will now cognitize … business plans of the next 10,000 startups are easy to forecast: Take X and add AI.”29

In this book, I argue that patterns in how GPTs diffuse throughout the economy illuminate a novel explanation for how and when technological changes affect power transitions. The emergence of GPTs—fundamental advances that can transform many application sectors—provides an opening for major shifts in economic leadership. Characterized by their scope for continuous improvement, pervasive applicability across the economy, and synergies with other technological advances, GPTs carry an immense potential for boosting productivity.30 Carefully tracking how the various applications of GPTs are adopted across various industries, a process I refer to as “GPT diffusion,” is essential to understanding how technological revolutions disrupt economic power balances.

Based on the experience of past GPTs, this potential productivity boost comes with one notable caveat: the full impact of a GPT manifests only after a gradual process of diffusion into pervasive use.31 GPTs demand structural changes across a range of technology systems, which involve complementary innovations, organizational adaptations, and workforce adjustments.32 For example, electrification’s boost to productivity materialized about five decades after the introduction of the first electric dynamo, occurring only after factories had restructured their layouts and there had been interrelated breakthroughs in steam turbines.33 Fittingly, after the release of GPT-3, OpenAI CEO Sam Altman alluded to this extended trajectory: “The GPT-3 hype is way too much … it still has serious weaknesses and sometimes makes very silly mistakes. AI is going to change the world, but GPT-3 is just a very early glimpse. We have a lot still to figure out.”34

Informed by historical patterns of GPT diffusion, my explanation for technology-driven power transitions diverges significantly from the standard LS account. Specifically, these two causal mechanisms differ along three key dimensions, which relate to the technological revolution’s impact timeframe, phase of relative advantage, and breadth of growth. First, while the GPT mechanism involves a protracted gestation period between a GPT’s emergence and resulting productivity boosts, the LS mechanism assumes that there is only a brief window during which countries can capture profits in leading sectors. “The greatest marginal stimulation to growth may therefore come early in the sector’s development at the time when the sector itself is expanding rapidly,” William Thompson reasons.35 By contrast, the most pronounced effects on growth arrive late in a GPT’s development.

Second, the GPT and LS mechanisms also assign disparate weights to innovation and diffusion. Technological change involves a phase when the technology is first incubated as a viable commercial application (“innovation”) and a phase when the innovation permeates across a population of potential users (“diffusion”). The LS mechanism is primarily concerned about which country dominates innovation in leading sectors, capturing the accompanying monopoly profits.36 Under the GPT mechanism, successful adaptation to technological revolutions is less about being the first to introduce major innovations and more about effectively adopting GPTs across a wide range of economic sectors.

Third, regarding the breadth of technological transformation and economic growth, the LS mechanism focuses on the contributions of a limited number of leading sectors and new industries to economic growth in a particular period.37 In contrast, GPT-fueled productivity growth is spread across a broad range of industries.38 Dispersed productivity increases from many industries and sectors come from the extension and generalization of localized advances in GPTs.39 Thus, the LS mechanism expects the breadth of growth in a particular period to be concentrated in leading sectors, whereas the GPT mechanism expects technological complementarities to be dispersed across many sectors.

A clearer understanding of the contours of technological change in times of economic power transition informs which institutional variables matter most. If the LS trajectory holds, then the most important institutional endowments and responses are those that support a monopoly on innovation in leading sectors. In the context of skill formation, institutional competencies in science and basic research gain priority. For instance, the conventional explanation of Germany’s industrial rise in the late nineteenth century attributes its technological leadership to investments in industrial research labs and highly skilled chemists. These supported Germany’s dominance of the chemical industry, a key LS of the period.40

The impact pathway of GPTs brings another set of institutional complementarities to the fore. GPT diffusion theory highlights the importance of “GPT skill infrastructure”: education and training systems that widen the pool of engineering skills and knowledge linked to a GPT. When widespread adoption of GPTs is the priority, it is ordinary engineers, not heroic inventors, who matter most. Widening the base of engineering skills associated with a GPT cultivates a more interconnected technological system, spurring cross-fertilization between institutions optimized for applied technology and those oriented toward foundational research.41

Returning to the example of late-nineteenth-century advances in chemicals, GPT diffusion spotlights institutional adjustments that differ from those of the LS mechanism. In a decades-long process, innovations in chemical engineering practices gradually enabled the chemicalization of procedures common to many industries beyond synthetic dyes, which was controlled by Germany. Despite trailing Germany in the capacity to produce elite chemists and frontier chemical research, the United States was more effective at adapting to chemicalization because it first institutionalized the discipline of chemical engineering.42

Of course, since GPT diffusion depends on factors aside from human capital, GPT skill infrastructure represents one of many institutional forces at work. Standards-setting organizations, financing bodies, and the competitiveness of markets can all influence the flow of information between the GPT domain and application sectors.43 Since institutions of skill formation produce impacts that spill over into and complement other institutional arrangements, they comprise the focus of my analysis.44

Assessing GPT Diffusion across Industrial Revolutions

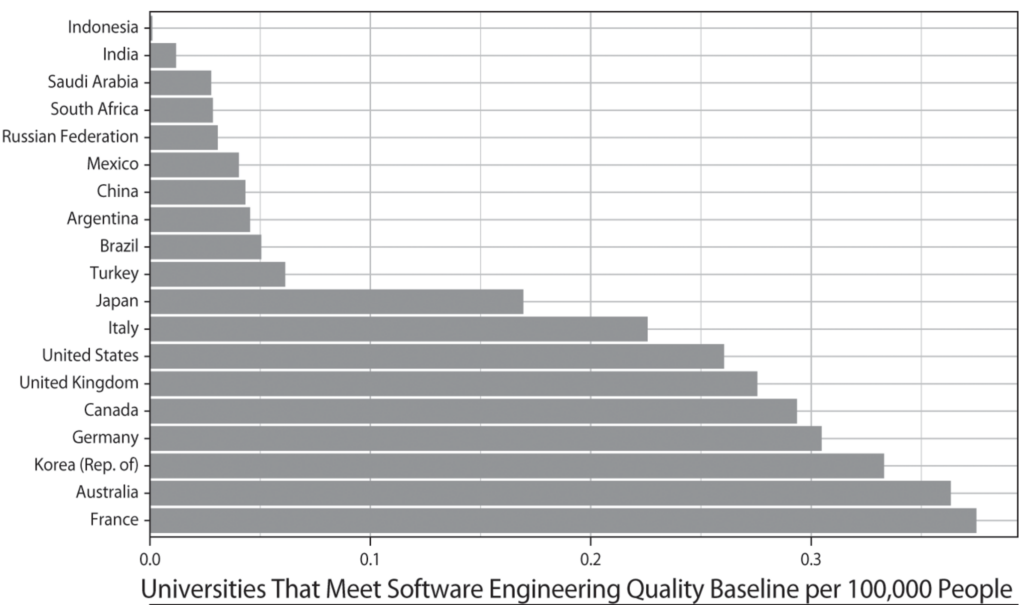

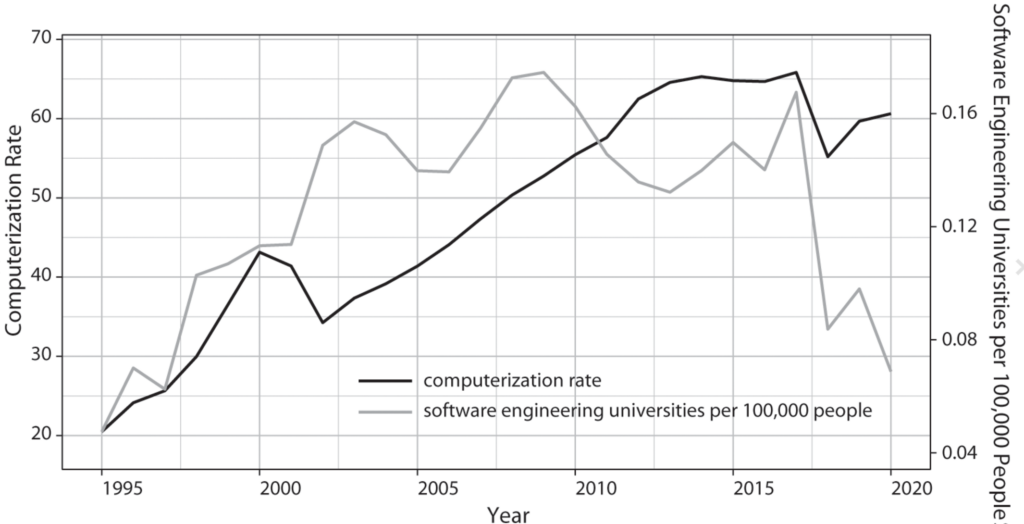

To test this argument, I employ a mixed-methods approach that pairs qualitative historical analysis with quantitative methods. Historical case studies permit me to thoroughly trace the interactions between technologies and institutions among great powers in previous industrial revolutions. I then explore the generalizability of GPT diffusion theory beyond the chosen set of great powers. Using data on nineteen countries from 1995 to 2020, I analyze the theorized connection between GPT skill infrastructure in software engineering and computerization rates.

To investigate the causal processes that connect technological changes to economic power transitions, I set the LS mechanism against the GPT diffusion mechanism across three historical case studies: Britain’s rise to preeminence in the First Industrial Revolution (IR-1); America’s and Germany’s overtaking of Britain in the Second Industrial Revolution (IR-2); and Japan’s challenge to America’s technological dominance in the Third Industrial Revolution (IR-3), or what is sometimes called the “information revolution.” This case setup allows for a fair and decisive assessment of the explanatory relevance of GPT diffusion theory in comparison to LS theory. Because the IR-1 and IR-2 function as typical cases where the cause and outcome are clearly present, they are ideal for developing and testing mechanism-based theories.45 The IR-3, a deviant case in that a technological revolution is not followed by an economic power transition, provides a different but still useful way to compare the two mechanisms.

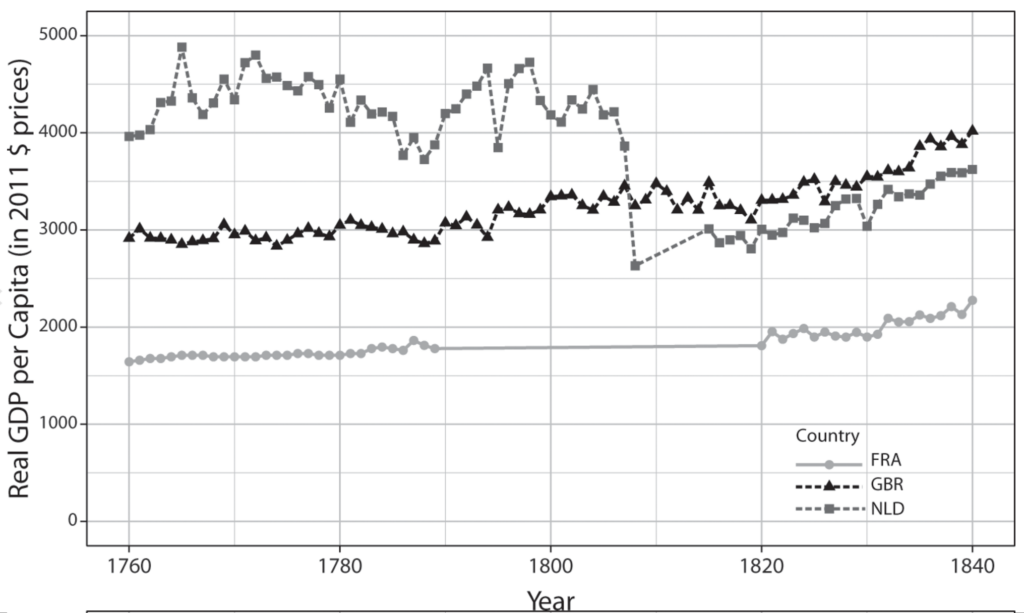

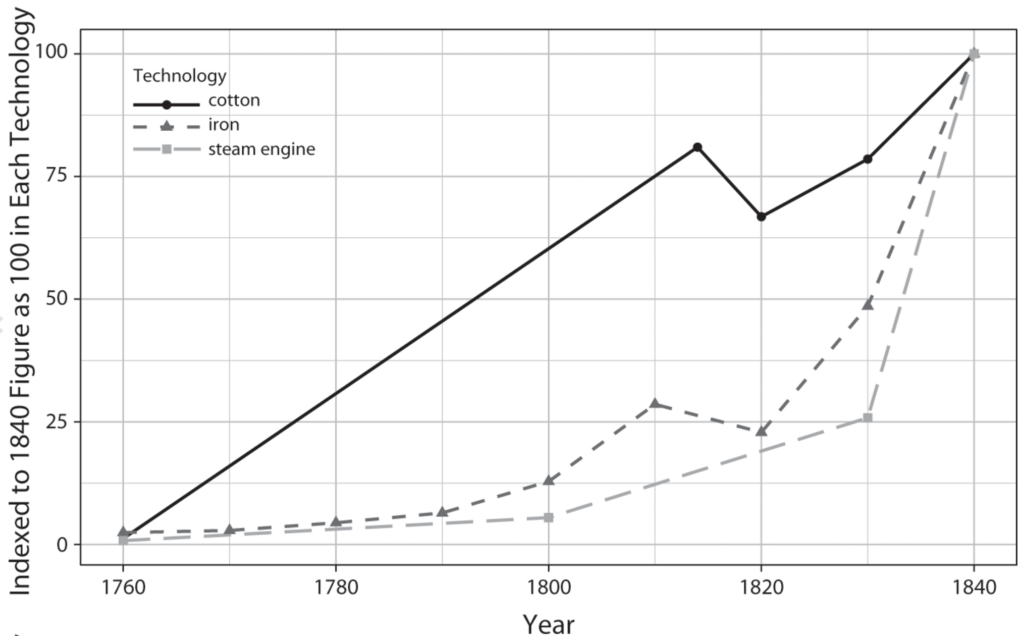

The IR-1 (1780–1840) is a paradigmatic case of technology-driven power transition. It is well established that the IR-1’s technological advances propelled Great Britain to unrivaled economic supremacy. As for the specific causal pathway, international relations scholarship tends to attribute Britain’s rise to its monopoly over innovation in cotton textiles and other leading sectors. According to these accounts, Britain’s technological leadership in the IR-1 sprang from its institutional capacity to nurture genius inventors in these sectors. Since the publication of these field-defining works, economic and technology historians have uncovered that the impacts on British industrialization of the two most prominent areas of technological change, cotton textiles and iron, followed different trajectories. Often relying on formal econometric methods to understand the impact of key technologies, these historical accounts question the prevailing narrative of the IR-1.

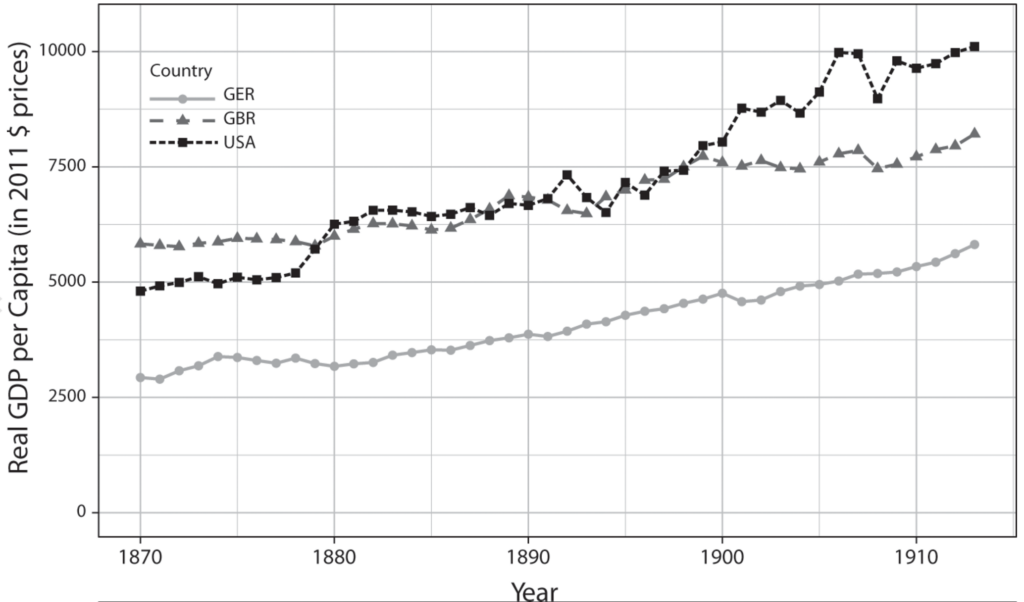

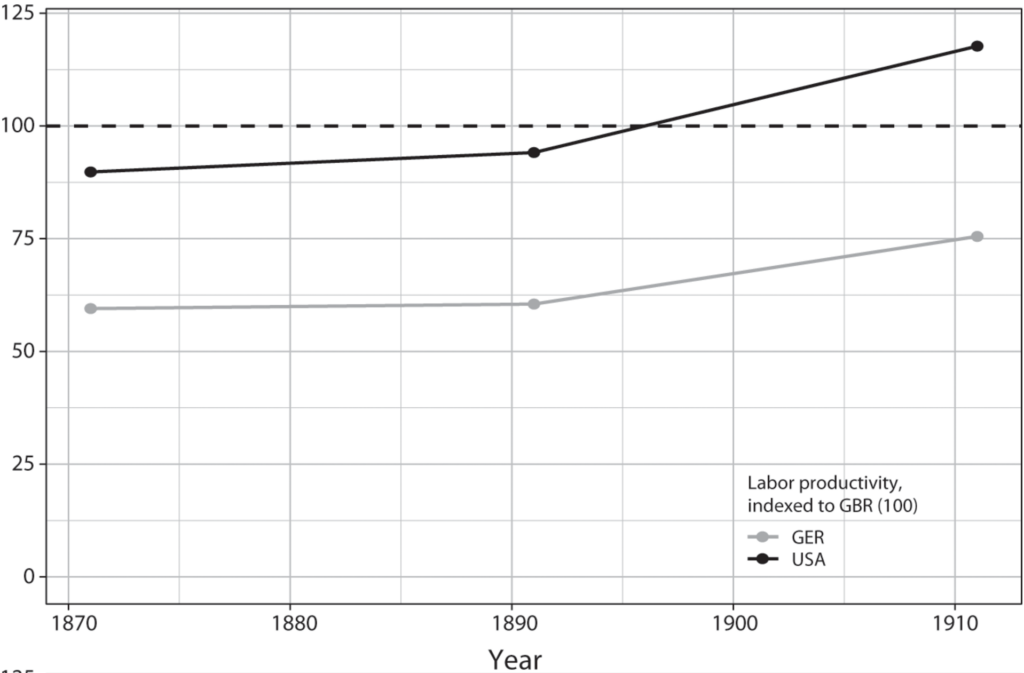

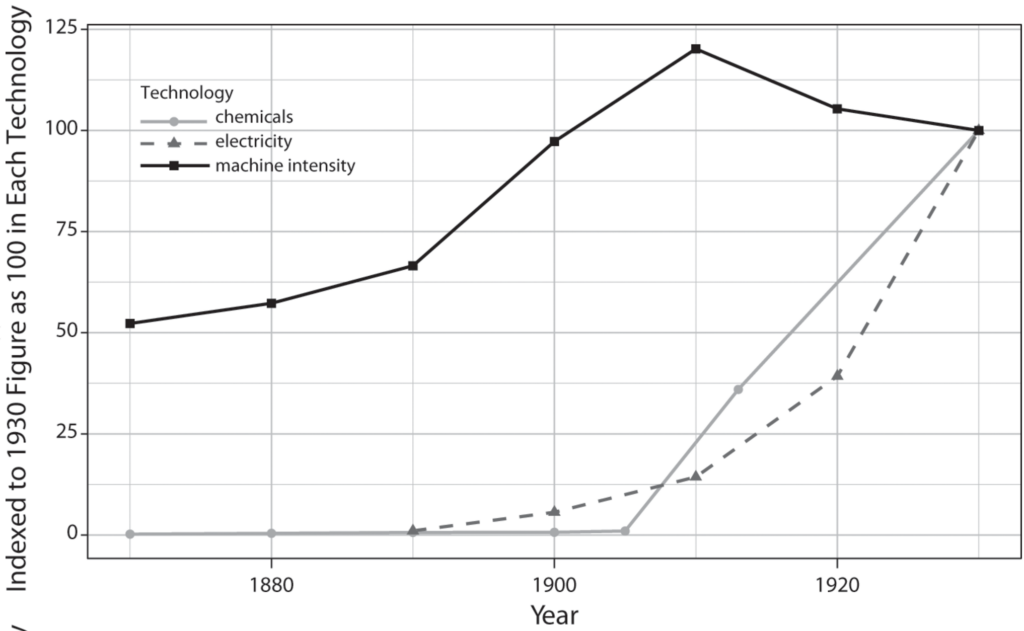

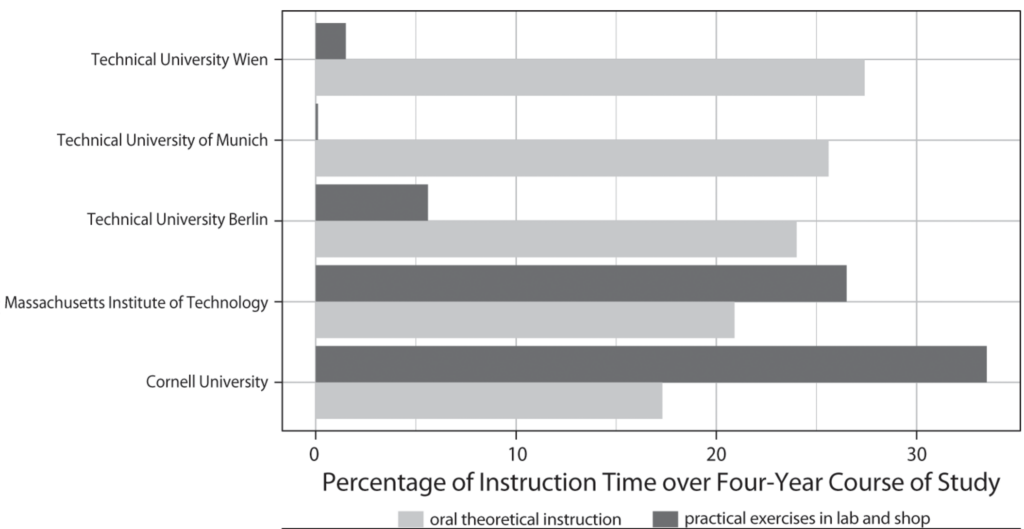

The IR-2 (1870–1914) supplies another opportunity to pit GPT diffusion theory against the LS account. International relations scholars interpret the IR-2 as a case in which Britain’s rivals challenged its economic leadership because they first introduced significant technological advances in leading sectors. Particular emphasis is placed on Germany’s ability to corner market shares in chemicals, which is linked to its strengths in scientific education and industrial research institutions. More granular data on cross-national differences in engineering education suggest that the U.S. technological advantage rested on the country’s wide base of mechanical engineers. Combined with detailed tracing of the pace and extent of technology adoption during this period, this chapter’s evidence suggests modifications to conventional understandings of the IR-2.

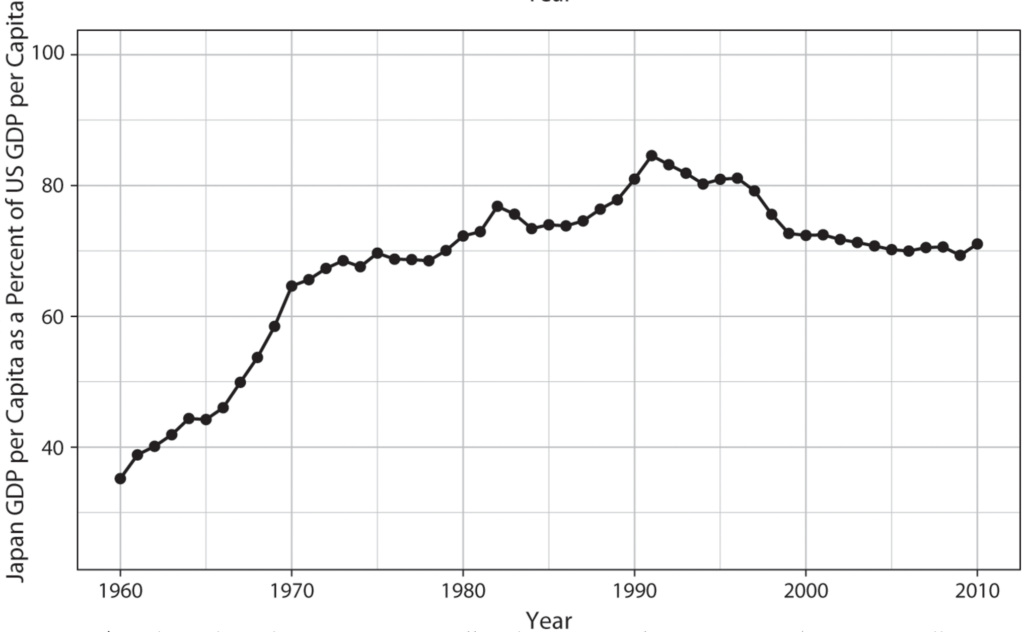

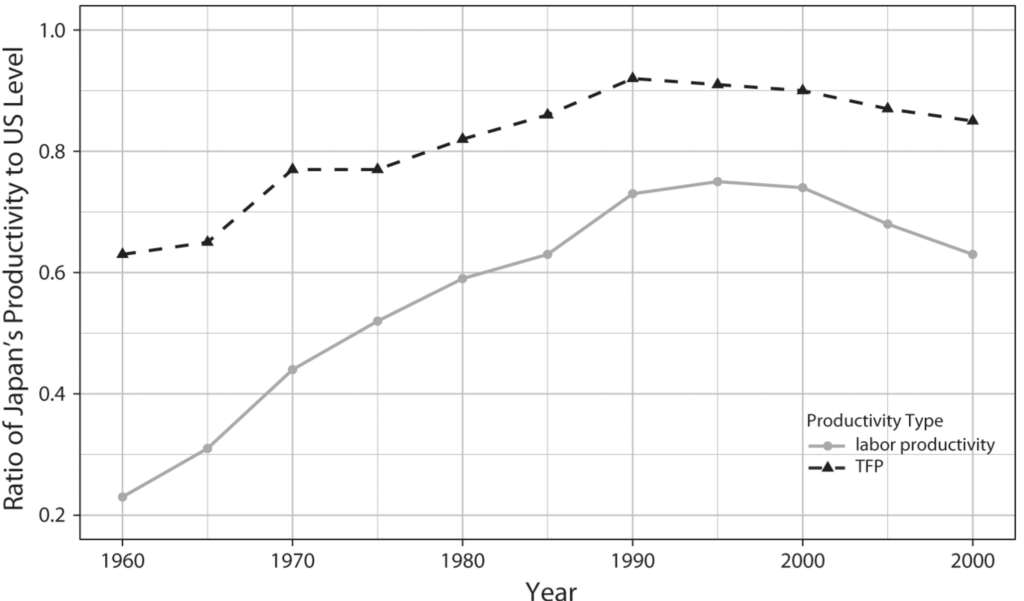

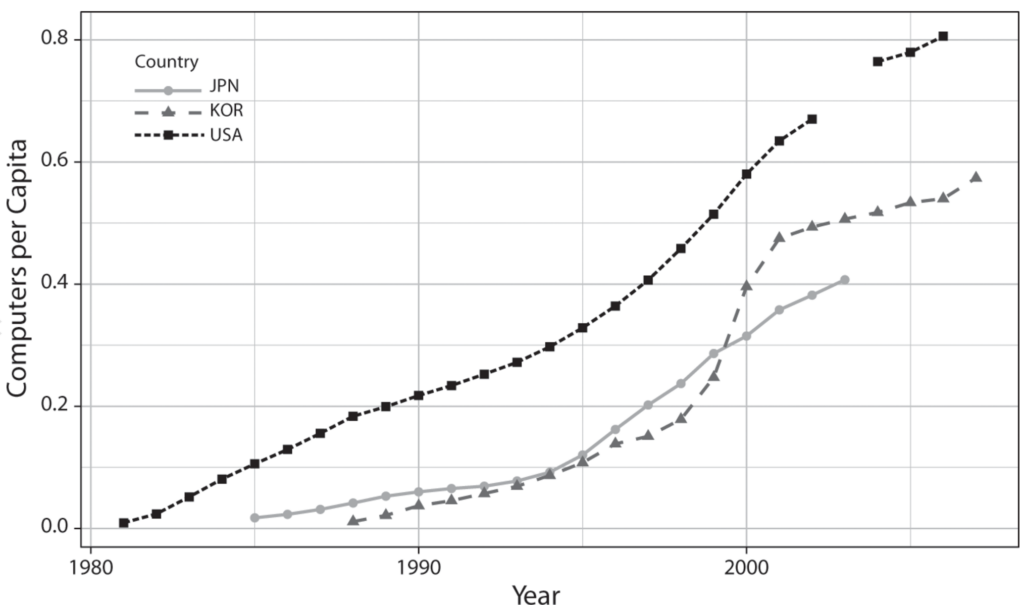

In the IR-3 (1960–2000), fundamental breakthroughs in information and communication technologies presented another opening for a shift in economic leadership. During this period, prominent thinkers warned that Japan’s lead in industries experiencing rapid technological change, including semiconductors and consumer electronics, would threaten U.S. economic leadership. Influential scholars and policymakers advocated for the United States to adopt Japan’s keiretsu system of industrial organization and its aggressive industrial policy approach. Ultimately, Japan’s productivity growth stalled in the 1990s. Given the absence of an economic power transition, the primary function of the IR-3 case therefore is to provide disconfirming evidence of the two explanations. If the components of the LS mechanism were present, then the fact that an economic power transition did not occur would damage the credibility of the LS mechanism. The same condition applies to GPT diffusion theory.

In each of the cases, I follow the same standardized procedures. First, I test three pairs of competing propositions about the key technological trajectories, derived from the different expectations of the LS and GPT mechanisms related to the impact timeframe, phase of relative advantage, and breadth of growth. Then, depending on whether the LS or GPT trajectory better accords with the historical evidence, I analyze the goodness-of-fit between the institutional competencies of leading industrial powers and the prevailing trajectory. For instance, if an industrial revolution is better characterized by the GPT trajectory, then the corresponding case analysis should show that differences in GPT skill infrastructure determine which powers rise and fall. Although I primarily distinguish GPT diffusion theory from the LS model, I also examine alternative factors unique to the particular case, as well as two other prominent explanations of how advanced economies differentially benefit from technological changes (the varieties of capitalism and threat-based approaches).

The historical case analysis supports the explanatory power of the GPT mechanism over the LS mechanism. In all three periods, technological changes affected the rise and fall of great powers in a gradual, decades-long impact pathway that advantaged those that effectively diffused GPTs across a broad range of sectors. Education and training systems that cultivated broad pools of engineering skills proved crucial to GPT diffusion.

Evaluating these two competing explanations requires a clear understanding of the cause and outcome that bracket both the GPT and LS mechanisms. The hypothesized cause is a “technological revolution,” or a period characterized by particularly disruptive technological advances.46 Since the shape of technological change is uneven, not all improvements in useful knowledge are relevant for power transitions.47 However, some extraordinary clusters of technological breakthroughs, often deemed industrial revolutions by historians, do have ramifications for the rise and fall of great powers.48 I am primarily interested in the pathway by which these technological revolutions influence the global distribution of power.

The outcome variable of interest is an economic power transition, in which one great power sustains productivity growth at higher levels than its rivals. The balance of power can shift in many ways; here I focus on relative economic growth rates because they are catalysts for intensifying hegemonic rivalries.49 Productivity growth, in particular, determines economic growth over the long run. Unique in its fungibility with other forms of power, sustained economic growth is central to a state’s ability to exert political and military influence. As demonstrated by the outcomes of interstate conflicts between great powers, economic and productive capacity is the foundation of military power.50

Lastly, the quantitative analysis supplements the historical case studies by scrutinizing the generalizability of GPT diffusion theory outside of great powers. A key observable implication of my argument is that the rate at which a GPT spreads throughout the economy owes much to that country’s institutional capacity to widen the pool of pertinent engineering skills and knowledge. Using a novel method to estimate the breadth of software engineering education at a cross-national level, I analyze the theorized connection between GPT skill infrastructure and computerization rates across nineteen advanced and emerging economies from 1995 to 2020. I supplement my time-series cross-sectional models with a duration analysis and cross-sectional regressions. Robust to many alternative specifications, my results show that, at least for computing technology, advanced economies that have higher levels of GPT skill infrastructure preside over higher rates of GPT diffusion.

Key Contributions

The book makes several contributions to scholarship on power transitions and the effects of technological change on international politics. First, it puts forward a novel explanation for how and when significant technological breakthroughs generate a power transition in the international system. GPT diffusion theory revises the dominant theory based on leading sectors, which holds significant sway over academic and policymaking circles. By deepening our understanding of how technological revolutions influence shifts in economic leadership, this book also contributes to long-standing debates about the causes of power transitions.51

Second, the findings of this book bear directly on present-day technological competition between the United States and China. Emphasizing where fundamental breakthroughs are first seeded, the LS template strongly informs not only assessments of the US-China competition for technological leadership but also the ways in which leading policymakers in both countries formulate technology strategies. It is no coincidence that the three cases in this study match the three technological revolutions referenced by Chinese president Xi in his speech on the IR-4 to the BRICS summit.

As chapter 7 explores in detail, GPT diffusion theory suggests that Xi, along with other leading policymakers and thinkers in both the United States and China, has learned the wrong lessons from previous industrial revolutions. If the IR-4 reshapes the economic power balance, the impact will materialize through a protracted period during which a GPT, such as AI, acquires a variety of uses in a wide range of productive processes. GPT skill infrastructure, not the flashy efforts to secure the high ground in innovation, will decide which nation owns the future in the IR-4.

Beyond power transitions, Technology and the Rise of Great Powers serves as a template for studying the politics of emerging technologies. An enduring dilemma is that scholars either assign too much weight to technological change or underestimate the effects of new technologies.52 Approaches that emphasize the social shaping of technology neglect that not all technologies are created equal, whereas technologically deterministic approaches discount the influence of political factors on technological development. By first distinguishing GPTs, together with their pattern of diffusion, from other technologies and technological trajectories, and then showing how social and political factors shape the pace and direction of GPT diffusion, my approach demonstrates a middle way forward.

Roadmap for the Book

The book proceeds as follows. Chapter 2 fleshes out the key differences between GPT diffusion theory and the LS-based account, as well as the case analysis procedures and selection strategy that allow me to systematically evaluate these two causal mechanisms. The bulk of the evidence follows in three case studies that trace how technological progress affected economic power transitions in the First, Second, and Third Industrial Revolutions.

The first two case studies, the IR-1 and IR-2, show that a gap in the adoption of GPTs, as opposed to monopoly profits from dominating LS innovations, was the crucial driver of an economic power transition. In both cases, the country that outpaced its industrial rivals made institutional adjustments to cultivate engineering skills related to the key GPT of the period. The IR-1 case, discussed in chapter 3, reveals that Britain was the most successful in fostering a wide pool of machinists who enabled the widespread diffusion of advances in iron machinery. In considering the IR-2 case, chapter 4 highlights how the United States surpassed Britain as the preeminent economic power by fostering a wide base of mechanical engineering talent to spread interchangeable manufacturing methods.

The IR-3 case, presented in chapter 5, demonstrates that technological revolutions do not necessarily always produce an economic power transition. The fact that Japan did not overtake the United States as the economic leader would provide disconfirming evidence of both the LS and GPT mechanisms, if the components of these mechanisms were present. In the case of the LS mechanism, Japan did dominate innovations in the IR-3’s leading sectors, including consumer electronics and semiconductor components. In contrast, the IR-3 does not discredit the GPT mechanism because Japan did not lead the United States in the diffusion of information and communications technology across a wide variety of economic sectors.

Chapter 6 uses large-n quantitative analysis to explore how GPT diffusion applies beyond great powers. Chapter 7 applies the GPT diffusion framework to the implications of modern technological breakthroughs for the US-China power balance. Focusing on AI technology as the next GPT that could transform the international balance of power, I explore the extent to which my findings generalize to the contemporary US-China case. I conclude in chapter 8 by underscoring the broader ramifications of the book.

2 GPT Diffusion Theory

HOW AND WHEN do technological changes affect the rise and fall of great powers? Specifically, how do significant technological breakthroughs result in differential rates of economic growth among great powers? International relations scholars have long observed that rounds of technological revolution lead to upheaval in global economic leadership, bringing about a power transition in the international system. However, few studies explore how this process occurs.

Those that do tend to fixate on the most dramatic aspects of technological change—the eureka moments and first implementations of radical inventions. Consequently, the standard account of technology-driven power transitions stresses a country’s ability to dominate innovation in leading sectors. By exploiting brief windows in which to monopolize profits in new industries, the country that dominates innovation in these sectors rises to become the world’s most productive economy. Explanations vary regarding why the benefits of leading sectors tend to accrue in certain nations. Some scholars argue that national systems of political economy that accommodate rising challengers can more readily accept and support new industries. Leading economies, by contrast, are victims of their past success, burdened by powerful vested interests that resist adaptation to disruptive technologies.1 Other studies point to more specific institutional factors that account for why some countries monopolize leading sectors, such as the degree of government centralization or industrial governance structures.2

An alternative explanation, based on the diffusion of general-purpose technologies (GPTs), draws attention to the less spectacular process by which fundamental innovations gradually diffuse throughout many industries. The rate and scope of diffusion is particularly relevant for GPTs, which are distinguished by their scope for continual improvement, broad applicability across many sectors, and synergies with other technological advances. Recognized by economists and historians as “engines of growth,” GPTs hold immense potential for boosting productivity.3 Realizing this promise, however, necessitates major structural changes across the technology systems linked to the GPT, including complementary innovations, organizational changes, and an upgrading of technical skills. Thus, GPTs lead to a productivity boost only after a “gradual and protracted process of diffusion into widespread use.”4 This is why more than five decades passed before key innovations in electricity, the quintessential GPT, significantly transformed manufacturing productivity.5

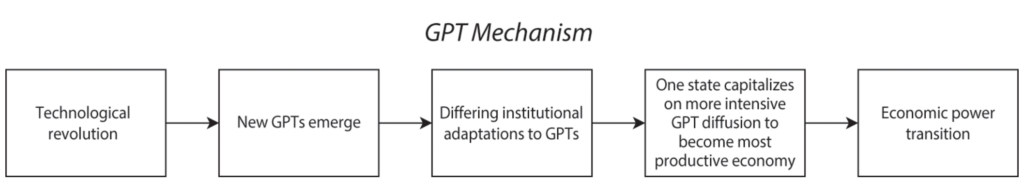

The process of GPT diffusion illuminates a pathway from technological change to power transition that diverges from the LS account (figure 2.1). Under the GPT mechanism, some great powers sustain economic growth at higher levels than their rivals do because, during a gradual process spanning decades, they more intensively adopt GPTs across a broad range of industries. This is analogous to a marathon run on a wide road. The LS mechanism, in contrast, specifies that one great power rises to economic leadership because it dominates innovations in a limited set of leading sectors and captures the accompanying monopoly profits. This is more like a sprint through a narrow running lane.

Why are some countries more successful at GPT diffusion? Building from scholarship arguing that a nation’s success in adapting to emerging technologies is determined by the fit between its institutions and the demands of evolving technologies, I argue that the GPT diffusion pathway informs the institutional adaptations crucial to success in technological revolutions.6 Unlike institutions oriented toward cornering profits in leading sectors, those optimized for GPT diffusion help standardize and spread novel best practices between the GPT sector and application sectors. Education and training systems that widen the base of engineering skills and knowledge linked to new GPTs, or what I call “GPT skill infrastructure,” are essential to all of these institutions.

FIGURE 2.1. Causal Diagrams for LS and GPT Mechanisms

The differences between these two theories of technological change and power transition are made clear when one country excels in the institutional competencies for LS product cycles but does not dominate GPT diffusion. Take, for example, chemical innovations and Germany’s economic rise in the late nineteenth century. Germany dominated major innovations in chemicals and captured nearly 90 percent of all global exports of synthetic dyestuffs.7 In line with the LS mechanism, this success was backed by Germany’s investments in building R&D labs and training doctoral students in chemistry, as well as a system of industrial organization that facilitated the rise of three chemical giants.8 Yet it was the United States that held an advantage in adopting basic chemical processes across many industries. As expected by GPT diffusion theory, the United States held institutional advantages in widening the base of engineering skills and knowledge necessary for chemicalization on a wide scale.9 This is when the ordinary tweakers and the implementers come to the fore, and the star scientists and inventors recede to the background.10

The rest of this chapter fleshes out my theoretical framework. It first clarifies the outcome I seek to explain: an economic power transition in which one great power becomes the economic leader by sustaining productivity growth at higher levels than its rivals. The starting point of my argument is that the diffusion of GPTs is central to the relationship between technological change and productivity leadership. This chapter explicates this argument by justifying the emphasis on both GPTs and diffusion, highlighting the differences between the GPT and LS mechanisms. It then extends the analysis to the institutional competencies that synergize with GPT trajectories. From the rich set of technology-institution interactions identified by evolutionary economists and comparative institutionalists, I justify my focus on institutions that enable countries to widen the skill base required to spread GPTs across industries. After differentiating my argument from alternative explanations, the chapter closes with a description of the book’s research methodology.11

The Outcome: Long-Term Economic Growth Differentials and Power Transitions

Power transitions are to the international system as earthquakes are to the geological landscape. Shifts in the relative power of leading nations send shock waves throughout the international system. What often follows is conflict, the most devastating form of which is a war waged by coalitions of great powers for hegemony over the globe.12 Beyond heightened risks of conflict, the aftershocks of power transitions reverberate in the architecture of the international order as victorious powers remake international institutions in their own images.13

While the power transition literature largely tackles the consequences of power transitions, I treat the rise and fall of great powers as the outcome to be explained. This follows David Baldwin’s instruction for international relations scholars “to devote more attention to treating power as a dependent variable and less to treating it as an independent variable.”14 Specifically, I explore the causes of “economic power transitions,” in which one great power sustains economic growth rates at higher levels than its rivals.15

It might not be obvious, at first glance, why I focus on economic power. After all, power is a multidimensional, contested concept that comes in many other forms. The salience of certain power resources depends on the context in which a country draws upon them to exert influence.16 For my purposes, differentials in economic growth are the most relevant considerations for intensifying hegemonic rivalry. An extensive literature has demonstrated that changes in relative economic growth often precede hegemonic wars.17

Moreover, changes in global political and military leadership often follow shifts in economic leadership. As the most fungible mode of power, economic strength undergirds a nation’s influence in global politics and its military capabilities.18 The outcomes of interstate conflicts bear out that economic and productive capacity is the foundation of military power.19 Paul Kennedy concludes that

all of the major shifts in the world’s military-power balances have followed alterations in the productive balances … the rising and falling of the various empires and states in the international system has been confirmed by the outcomes of the major Great Power wars, where victory has always gone to the side with the greatest material resources.20

How does one identify if or when an economic power transition occurs? Phrased differently, how many years does a great power need to lead its rivals in economic growth rates? How large does that gap have to reach? Throughout this book, I judge whether an economic power transition has occurred based on one great power attaining a lead in overall economic productivity over its rivals by sustaining higher levels of productivity growth rates.21 Productivity growth ensures that efficient and sustainable processes are fueling growth in total economic output. Additionally, productivity is the most important determinant of economic growth in the long run, which is the appropriate time horizon for understanding power transitions. “Productivity isn’t everything, but in the long run it is almost everything,” states Nobel Prize–winning economist Paul Krugman.22

Alternative conceptualizations of economic power cannot capture how effectively a country translates technological advance into national economic growth. Theories of geo-economics, for instance, highlight a state’s balance of trade in certain technologically advanced industries.23 Other studies emphasize a state’s share of world-leading firms.24 National rates of innovation, while more inclusive, measure the generation of novel technologies but not diffusion across commercial applications, thereby neglecting the ultimate impact of technological change.25 Compared to these indicators, which account for only a small portion of the value-added activities in the economy, productivity provides a more comprehensive measure of economic leadership.26

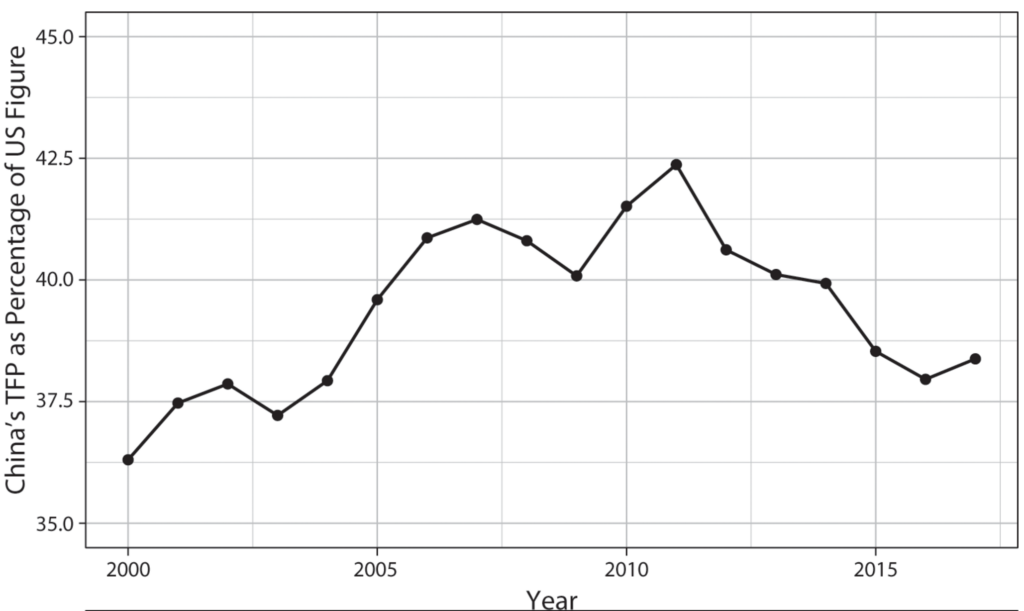

This focus on productivity is supported by recent work on power measurement, which questions measures of power resources based on economic size. Without accounting for economic efficiency, solely relying on measures of gross economic and industrial output provides a distorted view of the balance of power, particularly where one side is populous but poor.27 If national power was measured by GDP alone, China was the world’s most powerful country during the first industrial revolution. However, China’s economy was far from the productivity frontier. In fact, as the introduction chapter spotlighted, the view that China fell behind the West because it could not capitalize on productivity-boosting technological breakthroughs is firmly entrenched in the minds of leading Chinese policymakers and thinkers.

Lastly, it is important to clarify that I limit my analysis of productivity differentials to great powers.28 In some measures of productivity, other countries may rank highly or even outrank the countries I study in my cases. In the current period, Switzerland and other countries have higher GDP per capita than the United States; before World War I, Australia was the world leader in productivity, as measured by GDP per labor-hour.29 However, smaller powers like pre–World War I Australia and present-day Switzerland are excluded from my study of economic power transitions, as they lack the baseline economic and population size to be great powers.30

There is no exact line that distinguishes great powers from other countries.31 Kennedy’s seminal text The Rise and Fall of the Great Powers, for instance, has been challenged for not providing a precise definition of great power.32 Fortunately, across all the case studies in this book, there is substantial agreement on the great powers of the period. According to one measure of the distribution of power resources, which spans 1816 to 2012 and incorporates both economic size and efficiency, all the countries I study rank among the top six at the beginning of the case.33

The Diffusion of GPTs

Scholars often gravitate to technological change as the source of a power transition in which the mantle of industrial preeminence changes hands. However, there is less clarity over the process by which technical breakthroughs translate into this power shift among countries at the technological frontier. I argue that the diffusion of GPTs is the key to this mechanism. In this section, I first outline why my theory privileges GPTs over other types of technology. I then set forth why diffusion should be prioritized over other phases of technological change, especially innovation. Finally, I position GPT diffusion theory against the leading sector (LS) model, which is the standard explanation in the international relations literature.

Why GPTs?

Not all technologies are created equal. When assessed on their potential to transform the productivity of nations, some technical advances, such as the electric dynamo, rank higher than others, such as an improved sleeping bag. My theory gives pride of place to GPTs, such as electricity and the steam engine, which have historically generated waves of economy-wide productivity growth.34 Assessed on their own merits alone, even the most transformative technological changes do not tip the scale far enough to significantly affect aggregate economic productivity.35 GPTs are different because their impact on productivity comes from accumulated improvements across a wide range of complementary sectors; that is, they cannot be judged on their own merits alone.

Recognized by economists and economic historians as “engines of growth,” GPTs are defined by three characteristics.36 First, they offer great potential for continual improvement. While all technologies offer some scope for improvement, a GPT “has implicit in it a major research program for improvements, adaptations, and modifications.”37 Second, GPTs acquire pervasiveness. As a GPT evolves, it finds a “wide variety of uses” and a “wide range of uses.”38 The former refers to the diversity of a GPT’s use cases, while the latter alludes to the breadth of industries and individuals using a GPT.39 Third, GPTs have strong technological complementarities. In other words, the benefits from innovations in GPTs come from how other linked technologies are changed in response and cannot be modeled from a mere reduction in the costs of inputs to the existing production function. For example, the overall energy efficiency gains from merely replacing a steam engine with an electric motor were minimal; the major benefits from factory electrification came from electric “unit drive,” which enabled machines to be driven individually by electric motors, and a radical redesign of plants.40

Taken together, these characteristics suggest that the full impact of a GPT materializes via an “extended trajectory” that differs from those associated with other technologies. Economic historian Paul David explains:

We can recognize the emergence of an extended trajectory of incremental technical improvements, the gradual and protracted process of diffusion into widespread use, and the confluence with other streams of technological innovation, all of which are interdependent features of the dynamic process through which a general purpose engine acquires a broad domain of specific applications.41

For example, the first dynamo for industrial application was introduced in the 1870s, but the major boost of electricity to overall manufacturing productivity did not occur until the 1920s. Like other GPT trajectories, electrification required a protracted process of workforce skill adjustments, organizational adaptations, such as changes in factory layout, and complementary innovations like the steam turbine, which enabled central power generation in the form of utilities.42 To track the full impact of these engines of growth, one must travel the long roads of their diffusion.

Why Diffusion?

All technological trajectories can be divided into a phase when the technology is incubated and then first introduced as a viable commercial application (“innovation”) and a phase when the innovation spreads through a population of potential users, both nationally and internationally (“diffusion”).43 Recognizing this commonly accepted distinction, other studies of the scientific and technological capabilities of nations primarily focus on innovation.44 I depart from other works by giving priority to diffusion, since that is the phase of technological change most significant for GPTs.45

Undeniably, the activities and conditions that produce innovation can also spur diffusion.46 A firm’s ability to conduct breakthrough R&D does not just create new knowledge but also boosts its capacity to assimilate innovations from external sources (“absorptive capacity”).47 Faced with an ever-shifting technological frontier, building competency at producing new innovations gives a firm the requisite prior knowledge for identifying and commercializing external innovations. Other studies extend these insights beyond firms to regional and national systems.48 In order to absorb and diffuse technological advances first incubated elsewhere, they argue, nations must invest in a certain level of innovative activities.

This connection between innovation capacity and absorptive capacity could question the GPT mechanism’s attention to diffusion. Possibly, a country’s lead in GPT innovation could also translate directly into a relative advantage in GPT diffusion.49 Scholarship on the agglomeration benefits of innovation hot spots, such as Silicon Valley, support this case to some extent. Empirical analyses of patent citations indicate that knowledge spillovers from GPTs tend to cluster within a geographic region.50 In the case of electricity, Robert Fox and Anna Guagnini underscore that it was easier for countries with firms at the forefront of electrical innovation to embrace electric power at scale. The interconnections between the “learning by doing” gained on the job in these leading firms and academic labs separated nations in the “fast lane” and “slow lane” of electrification.51

Being the first to pioneer new technologies could benefit a state’s capacity to absorb and diffuse GPTs, but it is not determinative. A country’s absorptive capacity also depends on many other factors, including institutions for technology transfer, human capital endowments, openness to trade, and information and communication infrastructure.52 Sometimes the “advantages of backwardness” allow laggard states to adopt new technologies faster than the states that pioneer such advances.53 In theory and practice, a country’s ability to generate fundamental, new-to-the-world innovations can widely diverge from its ability to diffuse such advances.

This potential divergence is especially relevant for advanced economies, which encompass the great powers that are the subject of this research. Although innovation-centered explanations do well at sorting the advantages of technological breakthroughs to countries at the technological frontier compared to those trying to catch up, they are less effective at differentiating among advanced economies. As supported by a wealth of econometric research, divergences in the long-term economic growth of countries at the technology frontier are shaped more by imitation than innovation.54 These advanced countries have firms that can quickly copy or license innovations; first mover advantages from innovations are thus limited even in industries, like pharmaceuticals, that enforce intellectual property rights most strictly.55 Nevertheless, advanced countries that are evenly matched in their capacity for radical innovation can undertake vastly different growth trajectories in the wake of technological revolutions. Differences in diffusion pathways are central to explaining this puzzle.

This diffusion-centered approach is especially well suited for GPTs. Since GPTs entail gradual evolution into widespread use, there is a longer window for competitors to adopt GPTs more intensively than the leading innovation center. In other technologies, first-mover benefits from pioneering initial breakthroughs are more significant. For instance, leadership in the innovation of electric power technologies was fiercely contested among the industrial powers. The United States, Germany, Great Britain, and France all built their first central power stations within a span of three years (1882–1884), their first electric trams within a span of nine years (1887–1896), and their first three-phase AC power systems within a span of eight years (1891–1899).56 However, the United States clearly led in the diffusion of these systems: by 1912, its electricity production per capita had more than doubled that of Germany, its closest competitor.57 Thus, while most countries at the technological frontier will be able to compete in the production and innovation of GPTs, the hardest hurdles in the GPT trajectory are in the diffusion phase.

GPT Diffusion and LS Product Cycles

GPT diffusion challenges the LS-based account of how technological change drives power transitions. The standard explanation in the international relations literature emphasizes a country’s dominance in leading sectors, defined as new industries that experience rapid growth on the back of new technologies.58 Cotton textiles, steel, chemicals, and the automobile industry form a “classic sequence” of “great leading sectors,” developed initially by economist Walt Rostow and later adapted by political scientists.59 Under the LS mechanism, a country’s ability to maintain a monopoly on innovation in these emerging industries determines the rise and fall of lead economies.60

This model of technological change and power transition builds on the international product life cycle, a concept pioneered by Raymond Vernon. Constructed to explain patterns of international trade, the cycle begins with a product innovation and subsequent sales growth in the domestic market. Once the domestic market is saturated, the new product is exported to foreign markets. Over time, production shifts to these markets, as the original innovating country loses its comparative advantage.61

LS-based studies frequently invoke the product cycle model.62 Analyzing the effects of leading sectors on the structure of the international system, Gilpin states, “Every state, rightly, or wrongly, wants to be as close as possible to the innovative end of ‘the product cycle.’ ”63 One scholar described Gilpin’s US Power and the Multinational Corporation, one of the first texts that outlines the LS mechanism, as “[having] drawn on the concept of the product cycle, expanded it into the concept of the growth and decline of entire national economies, and analyzed the relations between this economic cycle, national power, and international politics.”64

The product cycle’s assumptions illuminate the differences between the GPT and LS mechanisms along three key dimensions. In the first stage of the product cycle, a firm generates the initial product innovation and profits from sales in the domestic market before saturation. Extending this model to national economies, the LS mechanism emphasizes the clustering of LS innovations and attendant monopoly profits in a single nation.65 “The extent of national success that we have in mind is of the fairly extreme sort,” write George Modelski and William Thompson. “One national economy literally dominates the leading sector during its phase of high growth and is the primary beneficiary of the immediate profits.”66 The GPT trajectory, in contrast, places more value on where technologies are diffused than where an innovation is first pioneered.67 I refer to this dimension as the “phase of relative advantage.”

In the next stage, the product innovation spreads to global markets and the technology gradually diffuses to foreign competitors. Monopoly rents associated with a product innovation dissipate as production becomes routinized and transfers to other countries.68 Mirroring this logic, Modelski and Thompson write, “[Leading sectors] bestow the benefits of monopoly profits on the pioneer until diffusion and imitation transform industries that were once considered radically innovative into fairly routine and widespread components of the world economy.”69 Thompson also states that “the sector’s impact on growth tends to be disproportionate in its early stages of development.”70

The GPT trajectory assumes a different impact timeframe. The more wide-ranging the potential applications of a technology, the longer the lag between its initial emergence and its ultimate economic impact. This explains why the envisioned transformative impact of GPTs does not appear straightaway in the productivity statistics.71 Time for complementary innovations, organizational restructuring, and institutional adjustments such as human capital formation is needed before the full impact of a GPT can be known. It is precisely the period when diffusion transforms radical innovations into routine components of the economy—the stage when the causal effects of leading sectors are expected to dissipate—that generates the productivity gap between nations.

The product cycle also reveals differences between the LS and GPT mechanisms regarding the “breadth of growth.” Like the product cycle’s focus on an innovation’s life cycle within a singular industry, the LS mechanism emphasizes the contributions of a limited number of new industries to economic growth in a particular period. GPT-fueled productivity growth, on the other hand, is dispersed across a broad range of industries.72 Table 2.1 specifies how LS product cycles differ from GPT diffusion along the three dimensions outlined here. As the following section will show, the differences in these two technological trajectories shape the institutional factors that are most important for national success in adapting to periods of technological revolution.

Table 2.1 Two Mechanisms of Technological Change and Power Transitions

| Mechanisms | Impact Timeframe | Phase of Relative Advantage | Breadth of Growth | Institutional Complements |

|---|---|---|---|---|

| LS product cycles | Lopsided in early stages | Monopoly on innovation | Concentrated | Deepen skill base in LS innovations |

| GPT diffusion | Lopsided in later stages | Edge in diffusion | Dispersed | Widen skill base in spreading GPTs |

While I have highlighted the differences between GPT diffusion and LS product cycles, it is important to recognize that there are similarities between the two pathways.73 Some scholars, for example, associate leading sectors with broad spillovers across economic sectors.74 In addition, lists of leading sectors and lists of GPTs sometimes overlap, as evidenced by the fact that electricity is a consensus inclusion on both lists. Moreover, both explanations begin with the same premise: to fully uncover the dynamics of technology-driven power transitions, it is essential to specify which new technologies are the key drivers of economic growth in a particular time window.75

At the same time, these resemblances should not be overstated. Many classic leading sectors do not have general-purpose applications. For instance, cotton textiles and automobiles both feature on Rostow’s series of leading sectors, and they are studied as leading sectors because each has “been the largest industry for several major industrial nations in the West at one time or another.”76 Although these were certainly both fast-growing large industries, the underlying technological advances do not fulfill the characteristics of GPTs. In addition, many of the GPTs I examine do not qualify as leading sectors. The machine tool industry in the mid-nineteenth century, for instance, was not a new industry, and it was never even close to being the largest industry in any of the major economies. Most importantly, though the GPT and LS mechanisms sometimes point to similar technological changes, they present very different understandings of how revolutionary technologies bring about an economic power transition. As the next section reveals, these differences also map onto varied institutional adaptations.

GPT Skill Infrastructure

New technologies agitate existing institutional patterns.77 They appeal for government support, generate new collective interests in the form of technical societies, and induce organizations to train people in relevant fields. If institutional environments are slow or fail to adapt, the development of emerging technologies is hindered. As Gilpin articulates, a nation’s technological fitness is rooted in the “extent of the congruence” between its institutions and the demands of evolving technologies.78 This approach is rooted in a rich tradition of work on the coevolution of technology and institutions.79

Understanding the demands of GPTs helps filter which institutional factors are most salient for how technological revolutions bring about economic power transitions. Which institutional factors dictate disparities in GPT adoption among great powers? Specifically, I emphasize the role of education and training systems that broaden the base of engineering skills linked to a particular GPT. This set of institutions, which I call “GPT skill infrastructure,” is most crucial for facilitating the widespread adoption of a GPT.

To be sure, GPT diffusion is dependent on institutional adjustments beyond GPT skill infrastructure. Intellectual property regimes, industrial relations, financial institutions, and other institutional factors could affect GPT diffusion. Probing inter-industry differences in technology adoption, some studies find that less concentrated industry structures are positively linked to GPT adoption.80 I limit my analysis to institutions of skill formation because their effects permeate other institutional arrangements.81 GPT skill infrastructure provides a useful indicator for other institutions that standardize and spread the novel best practices associated with GPTs.82

It should also be noted that the institutional approach is one of three main categories of explanation for cross-country differences in economic performance over the long term.83 Other studies document the importance of geography and culture to persistent cross-country income differences.84 I prioritize institutional explanations for two reasons. First, natural experiments from certain historical settings, in which institutional divergence occurs but geographical and cultural factors are held constant, suggest that institutional differences are particularly influential sources of long-term economic growth differentials.85 Second, since LS-based accounts of power transitions also prioritize institutional adaptations to technological change, my approach provides a more level test of GPT diffusion against the standard explanation.86

One final note about limits to my argument’s scope. I do not investigate the deeper origins of why some countries are more effective than others at developing GPT skill infrastructure. Possibly, the intensity of political competition and the inclusiveness of political institutions influence the development of skill formation institutions.87 Other fruitful lines of inquiry stress the importance of government capacity to make intertemporal bargains and adopt long time horizons in making technology investments.88 It is worth noting that a necessary first step to productively exploring these underlying causes is to establish which types of technological trajectories and institutional adaptations are at work. For instance, LS product cycles may be more closely linked to mercantilist or state capitalist approaches that favor narrow interest groups, whereas, political systems that incorporate a broader group of stakeholders may better accommodate GPT diffusion pathways.

Institutions Fit for GPT Diffusion

If GPTs drive economic power transitions, which institutions fit best with their demands? Institutional adaptations for GPT diffusion must solve two problems. First, since the economic benefits of GPTs materialize through improvements across a broad range of industries, capturing these benefits requires extensive coordination between the GPT sector and numerous application sectors. Given the sheer scope of potential applications, it is infeasible for firms in the GPT sector to commercialize the technology on their own, as the necessary complementary assets are embedded with different firms and industries.89 In the AI domain, as one example of a potential GPT, firms that develop general machine learning algorithms will not have access to all the industry-specific data needed to fine-tune those algorithms to particular application scenarios. Thus, coordination between the GPT sector and other organizations that provide complementary capital and skills, such as academia and competitor firms, is crucial. In contrast, for technologies that are not general-purpose, this type of coordination is less conducive and could even be detrimental to a nation’s competitive advantage, as the innovating firm could leak its technical secrets.90

Second, GPTs pose demanding conditions for human capital adjustments. In describing the connection between skill formation and technological fitness, scholars often delineate between general skills and industry-specific skills. According to this perspective, skill formation institutions that optimize for the former are more conducive to technological domains characterized by radical innovation, while institutions that optimize for the latter are more favorable for domains marked by incremental innovation.91 GPT diffusion entails both types of skill formation. The skills must be specific to a rapidly changing GPT domain but also broad enough to enable a GPT’s advance across many industries.92 Strong linkages between R&D-intensive organizations at the technological frontier and application areas far from the frontier also play a key role in GPT diffusion. This draws attention to the interactions between researchers who produce innovations and technicians who help absorb them into specific contexts.93

Education and training systems that foster relevant engineering skills for a GPT, or what I call GPT skill infrastructure, address both constraints. Engineering talent fulfills the need for skills that are rooted in a GPT yet sufficiently flexible to implement GPT advances in a wide range of sectors. Broadening the base of engineering knowledge also helps standardize best practices with GPTs, thereby coordinating information flows between the GPT sector and application sectors. Standardization fosters GPT diffusion by committing application sectors to specific technological trajectories and encouraging complementary innovations.94 This unlocks the horizontal spillovers associated with GPTs.95

Indeed, distinct engineering specializations have emerged in the wake of a new GPT. New disciplines, such as chemical engineering and electrical engineering, have proved essential in widening knowledge bases in the wake of a new GPT.96 Computer science, another engineering-oriented field, was central to US leadership in the information revolution.97 These professions developed alongside new technical societies—ranging from the American Society of Mechanical Engineers to the Internet Engineering Task Force—that formulated and disseminated guidelines and benchmarks for GPT development.98

Clearly, the features of GPT skill infrastructure have changed over time. Whereas informal associations systematized the skills crucial for mechanization in the eighteenth century, formal higher education has become increasingly integral to computerization in the twenty-first century.99 Some evidence suggests that computers and other technologies are skill-biased, in the sense that they favor workers with more years of schooling.100 These trends complicate but do not undercut the concept of GPT skill infrastructure. Regardless of the extent of formal training, all configurations of GPT skill infrastructure perform the same function: to widen the pool of engineering skills and knowledge associated with a GPT. This can take place in universities as well as in informal associations, provided these settings train engineers and facilitate the flow of engineering knowledge between knowledge-creation centers and application sectors.101

Which Institutions Matter?

The institutional competencies for exploiting LS product cycles are different. Historical analysis informed by this frame highlights heroic inventors like James Watt and pioneering research labs at large companies.102 Studying which countries benefited most from emerging technologies over the past two centuries, Herbert Kitschelt prioritizes the match between the properties of new technologies and sectoral governance structures. Under his framework, for example, tightly coupled technological systems with high causal complexity, such as nuclear power systems and aerospace platforms, are more likely to flourish in countries that allow for extensive state support.103 In other studies, the key institutional factors behind success in LS product cycles are education systems that subsidize scientific training and R&D facilities in new industries.104

These approaches equate technological leadership with a state’s success in capturing market shares and monopoly profits in new industries.105 In short, they use LS product cycles as the filter for which institutional variables matter. Existing scholarship lacks an institutional explanation for why some great powers are more successful at GPT diffusion.

Competing interpretations of technological leadership in chemicals during the late nineteenth century crystallize these differences. Based on the LS template, the standard account accredits Germany’s dominance in the chemical industry—as represented by its control over 90 percent of global production of synthetic dyes—to its investments in scientific research and highly skilled chemists.106 Germany’s dynamism in this leading sector is taken to explain its overall industrial dominance.107

GPT diffusion spotlights a different relationship between technological change and institutional adaptation. The focus turns toward institutions that complemented the extension of chemical processes to a wide range of industries beyond synthetic dye, such as food production, metals, and textiles. Under the GPT mechanism, the United States, not Germany, achieved leadership in chemicals because it first institutionalized chemical engineering as a discipline. Despite its disadvantages in synthetic dye production and chemical research, the United States was more effective in broadening the base of chemical engineering talent and coordinating information flows between fundamental breakthroughs and industrial applications.108

It is important to note that some parts of the GPT and LS mechanisms can coexist without conflict. A state’s capacity to pioneer new technologies can correlate with its capacity to absorb and diffuse GPTs. Countries that are home to cutting-edge R&D infrastructure may also be fertile ground for education systems that widen the pool of GPT-linked engineering skills. However, these aspects of the LS mechanism are not necessary for the GPT mechanism to operate. In accordance with GPT diffusion theory, a state can capitalize on GPTs to become the most powerful economy without monopolizing LS innovation.

Moreover, other dimensions of these two mechanisms directly conflict. When it comes to impact timeframe and breadth of growth, the GPT and LS mechanisms advance opposing expectations. Institutions suited for GPT diffusion can diverge from those optimized for creating new-to-the-world innovations. Research on human capital and long-term growth separates the effects of engineering capacity, which is commonly tied to adoptive activities, and other forms of human capital that are more often connected to inventive activities.109 This divergence can also be seen in debates over the effects of competition on technological activity. On the one hand, Joseph Schumpeter and others have argued that monopoly structures incentivize more R&D activity because the monopolists can appropriate all the gains from technological innovation.110 On the other hand, empirical work demonstrates that more competitive market structures increase the rate of technological adoption across firms.111 Thus, while there is some overlap between these two mechanisms, they can still be set against each other in a way that improves our understanding of technological revolutions and power transitions.

This theoretical framework differs from related work on the political economy of technological change.112 Scholars attribute the international competitiveness of nations to broader institutional contexts, including democracy, national innovation systems, and property rights enforcement.113 Since this book is limited to the study of shifts in productivity leadership at the technological frontier, many of these factors, such as those related to basic infrastructure and property rights, will not explain differences among technologically advanced nations.

In addition, most of the institutional theories put forth to explain the productivity of nations are technology-agnostic, in that they treat all forms of technological change equally. To borrow language from a former chairman of the US Council of Economic Advisers, they do not differentiate between an innovation in potato chips and an innovation in microchips.114 In contrast, I am specific about GPTs as the sources of shifts in competitiveness at the technological frontier.

Other theories identify key technologies but leave institutional factors at a high level of abstraction. Some scholars, for instance, posit that the lead economy’s monopoly on leading-sector innovation eventually erodes because of “ubiquitous institutional rigidities.”115 Unencumbered by the vested interests that resist disruptive technologies, rising challengers inevitably overtake established powers. Because these explanations are underspecified, they cannot account for cases where rich economies expand their lead or where poorer countries do not catch up.116

When interpreting great power competition at the technological frontier, adjudicating between the GPT and LS mechanisms represents a choice between two different visions. The latter prioritizes being the first country to introduce novel technologies, whereas the former places more value on disseminating and transforming innovations after their inception. In sum, industrial competition among great powers is not a sprint to determine which one can create the most brilliant Silicon Valley; it is a marathon won by the country that can cultivate the closest connections between its Silicon Valleys and its Iowa Citys.

Alternative Explanations

Although I primarily set GPT diffusion theory against the LS model, I also consider two other prominent explanations that make specific claims about how technological breakthroughs differentially advantage leading economies. Crucially, these two lines of thinking could account for differences in GPT diffusion, nullifying the import of GPT skill infrastructure.

Threat-Based Arguments

According to one school of thought, international security threats motivate states to invest in science and technology.117 When confronted with more threatening geopolitical landscapes, states are more incentivized to break down status quo interests and build institutions conducive to technological innovation.118 Militaries hold outsized influence in these accounts. For example, Vernon Ruttan argues that military investment, mobilized against war or the threat of war, fueled commercial advances in six technologies designated as GPTs.119 Studies of the success of the United States and Japan with emerging technologies also stress interconnections between military and civilian technological development.120 I group these related arguments under the category of threat-based theories.

Related explanations link technological progress with the balance of external threats and domestic roadblocks. Mark Taylor’s “creative insecurity” theory describes how external economic and military pressures permit governments to break from status quo interest groups and promote technological innovation. He argues that the difference between a nation’s external threats and its internal rivalries determines its propensity for innovation: the greater the difference, the greater the national innovation rate.121 Similarly, “systemic vulnerability” theory emphasizes the influence of external security and domestic pressures on the will of leaders to invest in institutions conducive to innovation, as well as the effect of “veto players” on their ability to do so.122

Certainly, external threats could impel states to invest more in GPTs, and military investment can help bring forth new GPTs; however, there are several issues with adapting threat-based theories to explain differences in GPT diffusion across great powers. First, threat-based arguments tend to focus on the initial incubation of GPTs, as opposed to the gradual spread of GPTs throughout a national economy. During the latter phase, a great deal of evidence suggests that civilian and military needs can greatly conflict.123 Besides, some GPTs, such as electricity in the United States, developed without substantial military investment. Since other civilian institutions could fill in as strong sources of demand for GPTs, military procurement may not be necessary for spurring GPT diffusion. Institutional adjustments to GPTs therefore can be motivated by factors other than threats. Ultimately, to further probe these points of clash, the impact of security threats and military investment must be traced within the historical cases.

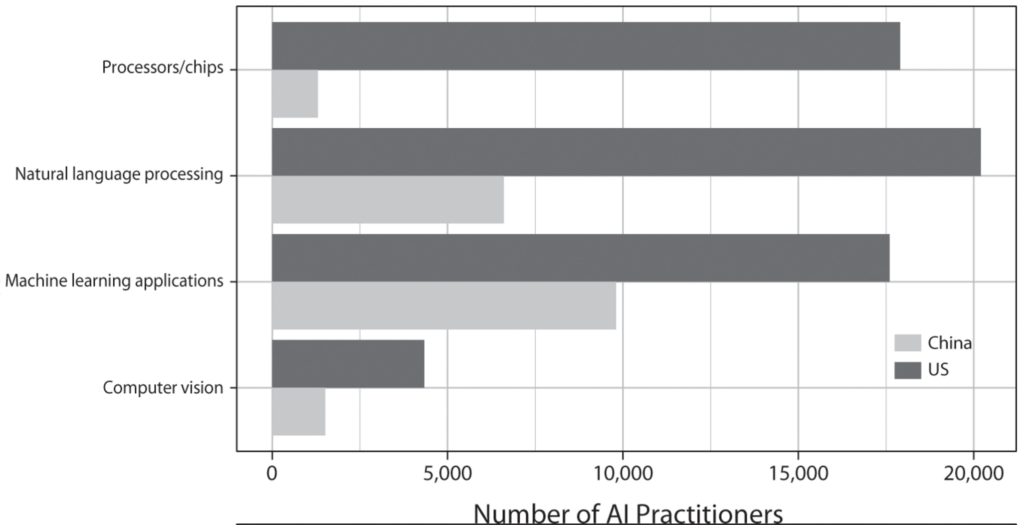

Varieties of Capitalism